Supreme Court IEEPA Tariffs Ruling: Duration & Credit Pulse – Week Ending February 22, 2026

Supreme Court IEEPA Tariffs Ruling Reshapes Rate Outlook: Duration & Credit Pulse – Week Ending February 22, 2026 | Mariemont Capital Duration & Credit Pulse Week Ending February 22, 2026 Executive Summary Bottom Line: The Supreme Court’s 6-3 IEEPA tariffs ruling on February 20 was the week’s defining event, yet the paradoxical market response — […]

CPI January 2026: Bull-Flattening Rally Drives 10-Year Treasury to 4.05%

CPI January 2026: Bull-Flattening Rally Drives 10-Year Treasury to 4.05% | Duration & Credit Pulse | Mariemont Capital Duration & Credit Pulse Week Ending February 15, 2026 Executive Summary Bottom Line: The January 2026 CPI January 2026 report delivered a positive surprise — headline inflation eased to 2.4% year-over-year against a 2.5% consensus — catalyzing […]

January 2026 Labor Market Data Shakes Treasury Yields

January 2026 Labor Market Data Shakes Treasury Yields: Duration & Credit Pulse – Week Ending February 8, 2026 | Mariemont Capital Duration & Credit Pulse Week Ending February 8, 2026 Executive Summary Bottom Line: A cascade of deteriorating January 2026 labor market data drove Treasury yields lower across the curve, with the 10-year falling 3 […]

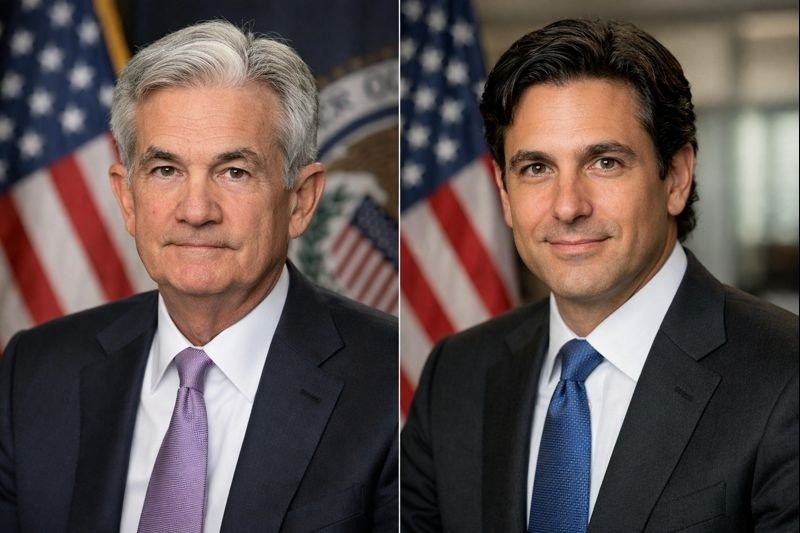

FOMC January 2026 Rate Decision: Fed Holds, Warsh Nominated

FOMC January 2026 Rate Decision: Fed Holds as Warsh Nomination Reshapes Policy Outlook | Duration & Credit Pulse Duration & Credit Pulse Week Ending February 1, 2026 Executive Summary Bottom Line: The FOMC January 2026 rate decision delivered an expected pause at 3.50-3.75%, but a notable 10-2 split vote and President Trump’s nomination of Kevin […]

Trump Greenland Tariffs Treasury Yields: 30-Year Hits 4.92%

Trump Greenland Tariffs Treasury Yields: 30-Year Approaches 5% Before Recovery – Week Ending January 25, 2026 | Mariemont Capital Duration & Credit Pulse Week Ending January 25, 2026 Executive Summary Bottom Line: Trump’s Greenland tariff threats and Japan’s government bond selloff created notable intraweek volatility, with the 30-year Treasury yield briefly touching 4.92%—its highest since […]

December CPI Eases: Treasury Yields Rise on Strong Labor

December CPI Inflation Eases: Treasury Yields Rise as Fed Independence Concerns Mount | Duration & Credit Pulse – Week Ending January 18, 2026 Duration & Credit Pulse Week Ending January 18, 2026 Executive Summary Bottom Line: December CPI delivered an encouraging downside surprise with core inflation cooling to 2.6% year-over-year, yet Treasury yields rose 5-6 […]

December 2025 Jobs Report: Treasury Yields Bull Flatten

December Jobs Report January 2026: Treasury Yields Bull Flatten as Labor Market Cools | Duration & Credit Pulse Duration & Credit Pulse Week Ending January 11, 2026 Executive Summary Bottom Line: The December jobs report delivered a mixed picture that reinforced expectations for an extended Fed pause—nonfarm payrolls added just 50,000 positions (missing the 73,000 […]

FOMC Minutes January 2026: Fed Division & Venezuela Oil Impact

FOMC Minutes January 2026: Year-End Rally Masks Fed Division | Duration & Credit Pulse Duration & Credit Pulse Week Ending January 4, 2026 Executive Summary Bottom Line: The first week of 2026 delivered a mild bear steepening as Treasury yields rose modestly across the curve, with the 10-year climbing 6 basis points to 4.19% at […]

Q3 GDP December 2025: Treasury Yields Steady as 4.3% Growth Beats Forecasts

Q3 GDP December 2025: Treasury Yields Steady as 4.3% Growth Beats Forecasts | Mariemont Capital Duration & Credit Pulse Week Ending December 27, 2025 Executive Summary Bottom Line: Treasury yields ended the holiday-shortened week marginally lower as the delayed Q3 GDP report revealed 4.3% annualized growth—the fastest pace in two years—while credit spreads compressed further […]

FOMC December 2025: Fed Cuts 25bp Amid Hawkish Pivot, 10-Year Yield Falls to 4.15%

FOMC December 2025: Fed Cuts 25bp Amid Hawkish Pivot, 10-Year Yield Falls to 4.15% | Mariemont Capital Duration & Credit Pulse Week Ending December 19, 2025 Executive Summary Bottom Line: The FOMC December 2025 meeting delivered a 25 basis point cut to 3.50-3.75% with an unusually hawkish tone, as an atypical three-way dissent revealed deep […]