Duration & Credit Pulse

Executive Summary

Bottom Line: The FOMC January 2026 rate decision delivered an expected pause at 3.50-3.75%, but a notable 10-2 split vote and President Trump's nomination of Kevin Warsh as next Fed Chair introduced new uncertainty. Treasury yields exhibited bull steepening, with 2-year yields declining 7 basis points while 30-year yields rose 5 basis points, widening the 2s10s spread to 71 basis points. Credit spreads remained near historic tights—high yield at just the 2nd percentile of its 5-year range—creating a notable disconnect with sharply declining consumer confidence, which fell to its lowest level since 2014.

FOMC January 2026: Fed Holds Rates in Split Decision

| Maturity | January 24, 2026 | January 31, 2026 | Weekly Δ | 5-Year Percentile |

|---|---|---|---|---|

| 2‑Year | 3.60% | 3.52% | −7 bp | 36th %ile (middle range) |

| 5‑Year | 3.82% | 3.79% | −4 bp | 52nd %ile (middle range) |

| 10‑Year | 4.23% | 4.24% | +1 bp | 73rd %ile (middle range) |

| 30‑Year | 4.83% | 4.87% | +5 bp | 93rd %ile (extreme) |

Bull Steepening Amid Fed Transition Uncertainty

Curve Analysis: The Treasury curve exhibited bull steepening dynamics as the front end rallied following the FOMC's dovish dissents while the long end sold off on Warsh nomination concerns. The 2s10s spread widened to 71 basis points from 63 basis points the prior week, while the 2s30s spread expanded to 135 basis points from 123 basis points. The 30-year yield at the 93rd percentile of its 5-year range reflects persistent term premium concerns around fiscal policy and leadership transition uncertainty.

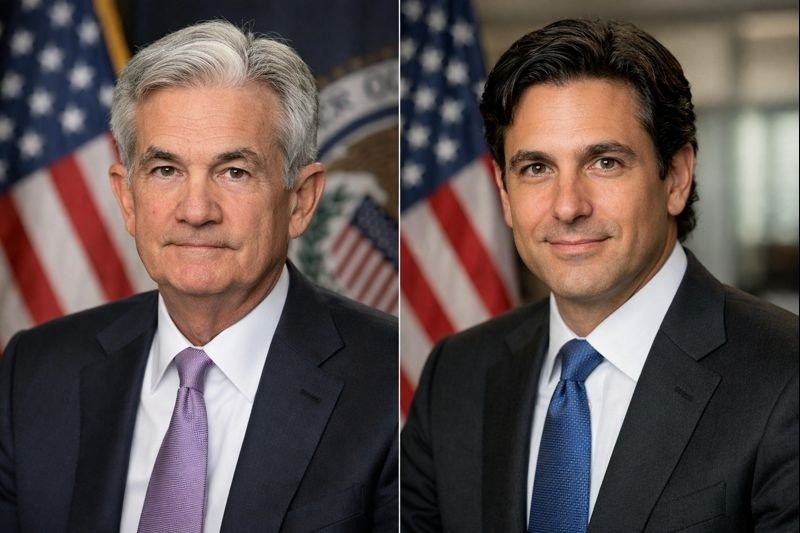

The Federal Reserve concluded its January 27-28 FOMC meeting by maintaining the federal funds target range at 3.50-3.75%, marking the first pause after three consecutive 25 basis point cuts in September, November, and December 2025. The decision featured a 10-2 split, with Governors Stephen Miran and Christopher Waller dissenting in favor of a quarter-point reduction—a notable division that suggests the Committee remains divided on the appropriate pace of normalization.

Chair Powell's press conference struck a more hawkish tone than markets anticipated. The statement language upgraded economic activity from expanding at a "moderate pace" to a "solid pace"—a subtle but meaningful shift that reinforced the case for patience. Powell's key remarks shaped fixed income sentiment throughout the week:

"It's hard to look at the data and say that policy is significantly restrictive right now."

"The economy is coming into 2026 on a firm footing... We do think we're well positioned after those three cuts to let the data speak to us."

"Most of the overshoot was in goods prices, which we think is related to tariffs... there's an expectation that sometime in the middle quarters of the year we'll see tariff inflation topping out."

Credit Spreads Near Historic Tights

| Metric | January 24, 2026 | January 31, 2026 | Weekly Δ | 5-Year Percentile |

|---|---|---|---|---|

| IG OAS | 69 bp | 71 bp | +2 bp | 8th %ile (extremely tight) |

| HY OAS | 239 bp | 234 bp | −5 bp | 2nd %ile (extremely tight) |

| VIX Index | 16.09 | 17.44 | +1.35 | 47th %ile (middle range) |

Credit markets continued to display resilience despite the week's political uncertainty. High yield spreads tightened 5 basis points to 234 basis points, remaining at just the 2nd percentile of their 5-year range—an extreme reading that reflects either strong fundamental conviction or potential complacency. Investment grade spreads widened modestly by 2 basis points to 71 basis points, still positioned at the 8th percentile. Primary issuance continued at a brisk pace, with January 2026 marking one of the busiest starts to a year on record for investment-grade corporate bond sales.

US Macroeconomic Assessment – Data Divergence Intensifies

The week's economic releases presented a study in contrasts. Consumer confidence fell sharply to 84.5, the weakest reading in over a decade, driven by deteriorating assessments of both current conditions and future expectations. The share of consumers viewing jobs as "plentiful" fell to 23.9% from 27.5%, while those considering jobs "hard to get" rose to 20.8%. Yet hard economic data painted a more constructive picture: durable goods orders surged 5.3% (well above the 3.7% consensus), led by a 97.6% spike in civilian aircraft bookings, while initial jobless claims remained low at 209,000.

Data calendar disruption persists: The government shutdown from Fall 2025 continued to distort the economic data calendar. Q4 2025 GDP (advance estimate) and December PCE inflation—the Fed's preferred price gauge—have been postponed to February 20, leaving policymakers without key inputs for the March meeting. This information vacuum complicates the FOMC's assessment of whether the economy requires additional accommodation. (For background on the shutdown's impact on markets, see our November 9, 2025 report.)

Labor market remains firm: Weekly jobless claims at 209,000 slightly exceeded the 205,000 consensus but remained near cycle lows. Continuing claims fell to 1.827 million, the lowest level since September 2024, suggesting limited labor market deterioration despite elevated policy uncertainty. The contrast between resilient employment data and plunging consumer sentiment remains a key puzzle for policymakers.

Federal Reserve Policy Outlook

Market pricing consolidated around 1-2 rate cuts for full-year 2026 following the FOMC's patient messaging, with the first reduction not expected until June at the earliest. Fed funds futures show virtually no probability of action at the March 17-18 meeting. The two dissents in favor of a cut—from Miran and Waller—indicate the Committee is not uniformly hawkish, but Powell's characterization of policy as potentially "not significantly restrictive" pushed back against expectations for near-term easing. (For context on how the Fed arrived at current policy settings, see our FOMC October 2025 analysis.)

The Warsh nomination introduces a new variable. While Senate confirmation remains uncertain—with Senator Thom Tillis reiterating opposition until the Justice Department's investigation into Powell is resolved—markets must now price potential policy shifts under new leadership starting in May. Warsh's historical criticism that the Fed has been too slow to normalize during expansions, combined with recent comments suggesting the Fed may have been too slow to cut, creates ambiguity about his actual policy direction.

Week Ahead: Employment Data Takes Center Stage

- Nonfarm Payrolls (February 7): January employment report will be closely watched for signs of labor market cooling. Any weakness could shift March FOMC pricing toward greater probability of a cut.

- ISM Services PMI (February 5): January services sector activity gauge provides key read on the dominant component of US economic output amid consumer confidence weakness.

- Warsh Confirmation Dynamics: Senate Banking Committee movement on the Fed Chair nomination could influence Treasury markets, particularly at the long end where term premium concerns remain elevated.

- Fed Speakers: Multiple FOMC participants scheduled to speak, potentially offering clarity on the Committee's reaction function and thresholds for additional cuts.

- Treasury Auctions: Refunding week continues with 10-year and 30-year auctions testing demand at elevated yield levels.

US Economic Positioning and Global Context

The US economy enters February with conflicting signals that complicate the fixed income outlook. The Fed's pause and Powell's relatively hawkish messaging contrast with two dovish dissents and looming leadership change. Credit markets remain constructive, with spreads at historical extremes and primary issuance robust. Yet consumer confidence at decade lows and delayed economic data create unusual uncertainty about underlying fundamentals. For historical context on how similar data divergences have resolved, explore our full archive of market insights.

For duration positioning, the bull steepening pattern suggests markets are pricing eventual Fed cuts while demanding higher term premium for long-end exposure given fiscal and leadership uncertainty. The 30-year yield at the 93rd percentile represents meaningful cheapness on a historical basis, but persistent supply concerns and Warsh nomination uncertainty may sustain elevated yields. Credit's extreme tightness offers limited cushion for any fundamental deterioration, making security selection and credit quality paramount.

Frequently Asked Questions

What did the Federal Reserve decide at its January 2026 meeting?

The FOMC held the federal funds rate steady at 3.50-3.75% in a split 10-2 decision, with Governors Miran and Waller dissenting in favor of a 25 basis point cut. This marked the first pause after three consecutive cuts in late 2025. Chair Powell noted the economy remains on "firm footing" and suggested current policy may not be significantly restrictive.

How did Treasury yields react to the Warsh nomination?

Treasury yields exhibited modest steepening following President Trump's January 30 nomination of Kevin Warsh as Fed Chair. The 10-year rose to 4.245% while the 30-year reached 4.881%. The front end rallied slightly as markets digested the Fed's dovish dissents, resulting in a curve steepening of approximately 8 basis points on the 2s10s spread.

Why did the Conference Board Index fall to its lowest level since 2014?

The Consumer Confidence Index fell 9.7 points to 84.5 in January, with all five components deteriorating. Consumers expressed deepening concerns about business conditions, the labor market, and income prospects. The Expectations Index at 65.1 remained well below the 80 threshold historically associated with recession risk.

What does the disconnect between credit spreads and consumer confidence indicate?

High yield spreads at the 2nd percentile of their 5-year range alongside consumer confidence at decade lows represents a notable divergence. Credit markets appear to be pricing strong corporate fundamentals and low default expectations, while consumers express significant pessimism. This gap warrants monitoring, though hard economic data remains supportive for now.

Key Articles of the Week

-

Federal Reserve Issues FOMC StatementFederal Reserve BoardJanuary 28, 2026Read Article

-

Fed Rate Decision January 2026: Holds Key Rate SteadyCNBCJanuary 28, 2026Read Article

-

Trump Taps Kevin Warsh to Chair Federal ReserveNBC NewsJanuary 30, 2026Read Article

-

US Consumer Confidence Fell Sharply in JanuaryThe Conference Board (via PR Newswire)January 27, 2026Read Article

-

Treasury Yields Hold Steady After Hot Producer Prices, Trump Picks WarshCNBCJanuary 30, 2026Read Article

-

Fed Leaves Rates Unchanged to Start 2026: Is a Cut Coming in March?J.P. MorganJanuary 28, 2026Read Article

-

Americans' Confidence in US Economy Falls Sharply in JanuaryABC NewsJanuary 27, 2026Read Article